Michael Mueller, CEO of Valora Group, looks back on 2020. The company’s main focus was on coping with the COVID-19 pandemic. In the interview he explains why Valora will emerge strengthened from the crisis.

Michael Mueller, how did you experience 2020?

Nobody would have thought at the start of 2020 that a pandemic would have such a drastic impact on all our lives. The COVID-19 crisis also had a major impact on Valora’s business development in 2020. The official restrictions brought in to contain the virus led to a collapse in customer footfall, with figures down by as much as –80% at highly frequented locations during the first lockdown. As a result, our sales fell by –17%. And nevertheless, we proved that Valora can withstand even the most adverse situations thanks to its resilient business model.

How satisfied are you with Valora’s operating result?

I am pleased that, in spite of everything, we achieved a positive operating profit of CHF 14 million in 2020 and strong free cash flow of CHF 38 million – EBIT was at the upper end of our financial outlook despite the second wave of the virus from late autumn and the renewed introduction of more stringent restrictions. The good start to the year, an uptick in sales between the phased lifting of the first lockdown from the end of April and the start of the second wave, a relatively stable gross profit margin and consistent cost controlling helped us to achieve this result. However, this was primarily thanks to the service provided by our staff and operating partners. They went the extra mile for our customers and Valora during this period, which has been tough at both a personal and professional level. They deserve all my respect and gratitude.

What were the main pillars of your crisis strategy?

In recent years, we have established a strong position in our markets as a focused foodvenience provider. Even during the lockdown, we were able to maintain business continuity and contribute to ensuring that the population was provided with basic supplies. We ensured the safety of both our customers and staff through the introduction of comprehensive protection concepts. From a financial perspective, we were extremely strict with our net working capital from an early stage of the crisis and deferred or prioritised investments. First and foremost, we moved quickly to take holistic measures to lower our cost base. And we will continue to do this moving forwards.

In 2020, you offset more than half of the reduction in gross profit through saving measures. How did you achieve this?

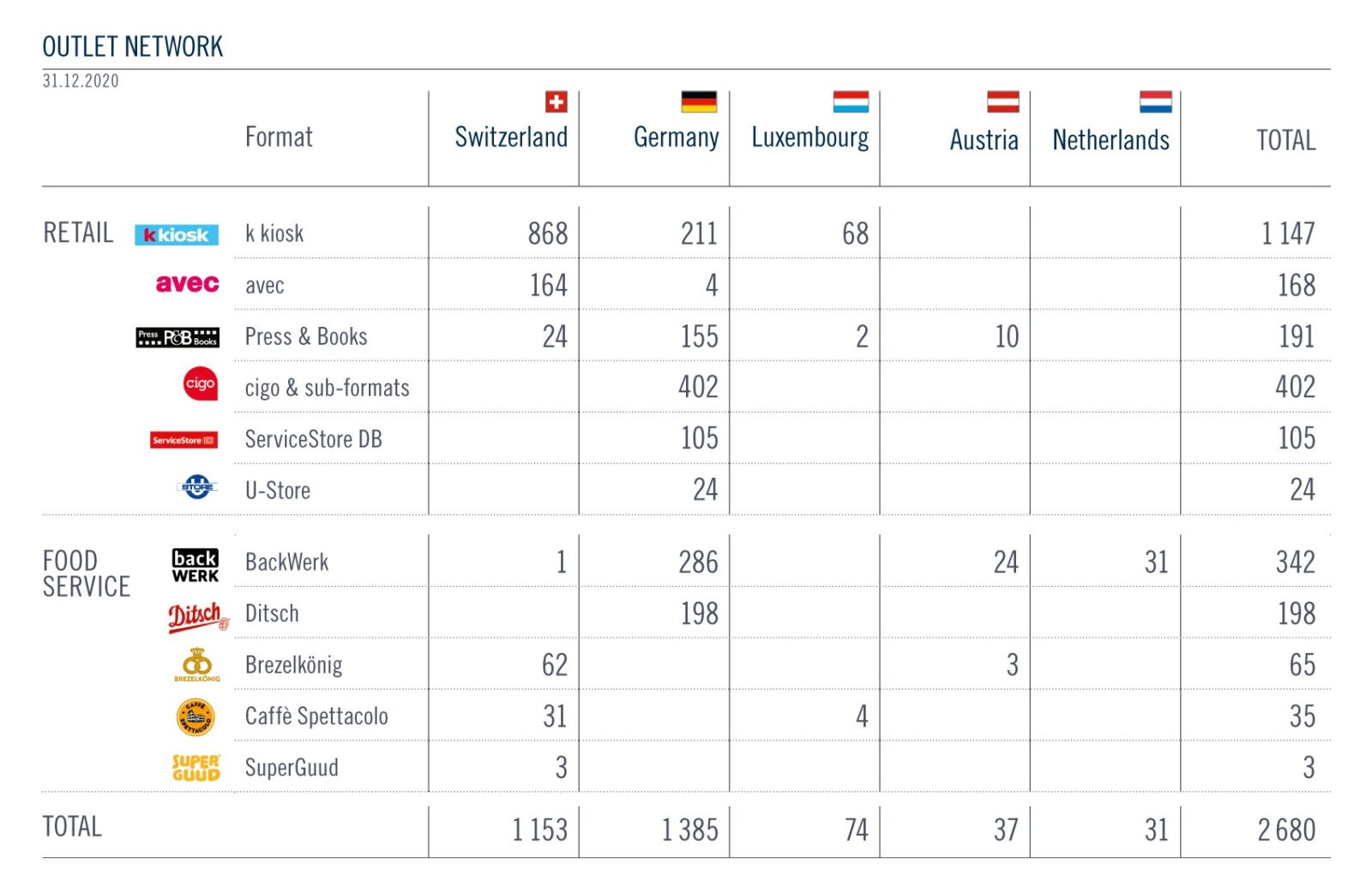

We cut costs by almost 12% compared to 2019 by prioritising projects in a targeted manner, optimising our sales outlet network and further reducing our central costs. We claimed short-time working for our staff – for over half the workforce at times. As a result, we thankfully only had to cut a small number of jobs.

“We finished 2020 with positive EBIT and strong free cash flow.”

Did you do anything extra for employees placed on short-time working?

We made up their salary shortfall during the initial stage of the crisis, meaning they were paid in full. We then ensured that any shortfall would not exceed 20% in those instances where the government paid out less than 80% of salaries, as is the case in Germany. We also subsidised our franchise and agency partners and helped them when faced with liquidity bottlenecks with a sum in the low double-digit millions. In addition, we cooperated closely with them when applying for government support.

To what extent did you optimise your sales outlet network?

The development in customer footfall varied depending on the stringency of the official measures in place. We continually changed our opening times to reflect what was happening on the ground, meaning it was a dynamic process. At the height of the lockdown in April 2020, we operated about 40% of our sales outlets with reduced opening hours, while around 20% were closed – some of the closings were by official decree. In spite of the restrictions tightening again, these numbers dropped to about 25% and 15%, respectively, at year-end. We only had to close about 40 of a good 2,700 sales outlets due to the pandemic.

Where did the crisis have the greatest impact?

The restrictions meant that there was less opportunity to purchase comestibles for consumption when on the move, while the level of need and desire for such purchases also declined. This impacted our food category as a whole and especially the Food Service formats BackWerk, Ditsch, Caffè Spettacolo and Brezelkönig. They are particularly exposed, not just because they sell food, but also because they are primarily located at public transport hubs. Overall, sales in the high-margin food category fell by –28% in local currency, having grown by almost 3% in January and February.

In what ways did the retail business benefit?

On the one hand, the retail formats are also located in the agglomeration, at service stations and shopping centres – areas that were relatively well frequented. Our retail business also has a broader product range than the Food Service. Our high competence in the tobacco and press categories proved to be a strength during the crisis. In spite of a fall in external sales of –13%, Retail thus achieved an EBIT margin of almost 2%.

And what about the margin for Food Service?

Discounting depreciation, the Food Service margin at EBITDA level was actually about 8% and thus above that of Retail. That is evidence of solid profitability, even if external sales fell by almost a third in 2020.

“The employees deserve all my respect and gratitude.”

How did the B2B pretzel business perform?

We also felt the impact of the sharp downturn in the out-of-home and food service market in this area, albeit not to the same extent as in our Food Service formats. Our very international portfolio of food service customers, who are not only active in high-frequency locations, has certainly contributed to this. Thanks to innovative product creations, we not only received new orders from existing customers, but also gained new customers, for example from the retail sector. Moreover, the situation in Europe was different to that in the US where our B2B business continued to grow. We were also helped by the fact that we can now package products in line with customer preferences at our Cincinnati facility thanks to the new production line – the timing during the pandemic couldn’t have been better.

Have you done anything else to enhance your food offering?

We certainly have. For example, in response to the trend towards higher nutritional awareness, we launched innovative products with plant-based meat substitutes at Brezelkönig. We expanded our fresh vegan and vegetarian product offering at avec. And we further developed our entire range of filled products at BackWerk.

Were there also opportunities for you to exploit in 2020 in spite of the crisis?

Yes, absolutely. Changing customer behaviour and the COVID-19 pandemic are adding impetus to digital, lowcontact convenience solutions. We therefore systematically pushed ahead with their development and expanded our own expertise.

Can you give an example?

The automated self-checkout is a good example here. Due to the big customer response, we extended the contract term again for the cashier-free, 24/7 avec box at ETH Zurich Hönggerberg until the end of May 2021. Since December 2020, we have been testing a self-checkout solution via the avec app at the two avec stores in Zurich Oerlikon in parallel with staffed checkouts. We also launched a hybrid model at the end of January 2021 in the form of avec 24/7. While the avec store is a regular shop with staff during the week, on Sundays it turns into an autonomous operation. Once the COVID-19-induced ban on night-time shopping is lifted in Zurich, people will also be able to use the app to go shopping at night.

“Changing customer behaviour is adding impetus to digital convenience solutions.”

Demand keeps rising for e-commerce, delivery services and loyalty programmes.

Yes, that’s why we introduced the pilot version of our online store www.avecnow.ch in the middle of the first lockdown. Smaller convenience purchases are delivered within an hour or so. We are offering it in Zurich for the time being. We also brought all of our Swiss Food Service formats onto the delivery platforms of third-party providers. Moreover, we now have an optimised version of the Caffè Spettacolo Loyalty app with a new online solution for pre-ordering coffee anywhere in Switzerland.

“Valora is investing in the future.”

Have you had any more successes in the area of digitalisation?

As regards process efficiency, in 2020 we were able to complete the final component of the rollout of a shared, future-oriented ERP platform in the Retail division. The sales outlets in Switzerland, Luxembourg and now in Germany too are all working on the same IT platform with a common goods management system.

Did you also invest elsewhere in implementing your strategy in 2020?

In spite of the pandemic, we invested CHF 55 million in 2020. The investments correspond to a good 60% of what we did the year before. In the first quarter, we concluded the expansion of the pretzel production facilities in Germany and the US in full and according to plan. We also invested further into the conversion of the locations secured until 2030 through the SBB tender into avec convenience stores and modernised k kiosk sales outlets with more food.

Are you progressing with the SBB conversions?

The conversion work was on track at the start of the year. We then had to stop construction until the end of June due to COVID-19. We have made good progress once more since then. Among others, we have converted several former Migrolino sites at very attractive locations. We have only had to push back 30 conversions and we expect the project to be completed in 2022.

What do the customers say about the new avec stores?

The initial signs with respect to the performance of the new avec stores are very promising. The converted sales outlets at SBB locations and service stations where we are also expanding with avec are performing at an above-average level when compared to the existing shops. We are also encouraged by the customer feedback. We have experienced the same for our two German BackWerk sites in Moers und Neuss, both of which we modernised in a pilot on the basis of the successful Dutch concept.

“We have a strong balance sheet and are financially stable and flexibly positioned.”

Valora also wants to be more sustainable. Have you made progress?

We demonstrated our reliability as an employer last year, especially with the short-time working arrangement and partner support. Wherever possible, we also adjusted our range quickly and efficiently in line with the prevailing situation in order to avoid food being wasted. We are also working with organisations like Too Good To Go, with which we have saved over 270,000 food portions since 2019. On the other hand, we successfully concluded other initiatives unrelated to the crisis, for example the launch of a new job platform and the switch to 100% fair trade coffee for all own brands. Nonetheless, it is true that we were held back by the COVID-19 crisis. But our commitment remains: sustainability will become part of our daily operations.

Valora increased its capital at the end of the year. What was the decisive factor behind this move?

We successfully placed 440,000 shares in November 2020 and generated a gross return of CHF 70 million. This ultimately led to a higher cash holding and lower net debt (CHF 212 million as at the end of 2020). On that basis, we were able to improve our COVID-19 headroom for the leverage ratio covenant of the syndicated loan facility negotiated in April for CHF 150 million and extend it by a year to the end of June 2022. Valora thus has a strong balance sheet and good debt maturity profile, meaning we are financially stable and flexible even during these turbulent times.

Does this mean acquisitions are still on the agenda?

Yes. We don’t want to restrict ourselves to investing in our core business. We also want to benefit from a possible market consolidation owing to the crisis.

Is the foodvenience business still attractive at all?

We are convinced that out-of-home consumption will recover at highly frequented locations once the restrictions are relaxed. There were indications of this with the easing of measures following the spring lockdown. The foodvenience market will also remain attractive in the future.

Half of Valora’s points of sale are situated at highly frequented public transport locations. Will mobility return?

People will start moving more again. Presumably, however, some people may work from home more in future. According to our projections, the impact on mobility numbers compared to the precrisis year should be in the –5 to –10% range. It’s important for us that the rents reflect this new economic reality with respect to where the stores are located.

“The foodvenience business will also remain attractive in future.”

What is the latest in the negotiations with your landlords?

In spite of the enduring nature of the decline in footfall, rents for our entire portfolio were only reduced by slightly over –10% in 2020 – and that was only for the lockdown periods in most cases. The high minimum rents in the revenue-dependent leases prevented us from balancing out the risk distribution with the landlords. Negotiations for 2021 and beyond are continuing unabated. Notwithstanding that, we assume that the crisis will lead to vacancies and thus more competitive new rental rates, including at attractive locations.

“Out-of-home consumption will recover when the time comes to ease the restrictions.”

Are you making any adjustments to your 2025 strategy?

The strategy as communicated in 2019 remains valid. We have planned investments of about CHF 60 million for 2021 – primarily for the further SBB conversion work. Growth, innovation, efficiency, a performance-oriented culture and sustainability are indispensable to our long-term success. We also consider the operational financial targets to be realistic. There may be minor deviations from the schedule, depending on how quickly we overcome the crisis.

What awaits us in 2021?

We currently find ourselves fully in the second wave of the pandemic. The impact has been stronger than we anticipated. Despite gradual relaxation of the government restrictions from March 2021, customer frequency is likely to remain comparably low until the middle of the year. However, we expect the business to develop above the previous year in the second half of 2021. It has to be assumed that demand for food-to-go will recover more slowly than the other categories due to the persistent restrictions. Nevertheless, food remains the main driver of our growth. The food category is also likely to benefit disproportionately from the recovery later on. Our investment focus is currently the conversion of the SBB sites. We are also moving forward with the development of new, digital convenience solutions.

What do you expect in terms of the 2021 result?

It is also primarily thanks to the retail business that our business model has proven resilient during this crisis. It is important to keep our cost base under control. In 2020, we adjusted our costs sustainably and across the board. We can now reap the rewards of this. Today, we expect to be comparably profitable on a monthly basis by the end of the year as we were in the time before the crisis. However, it is still uncertain, when and to what extent governments will ease their restrictions. It is therefore not yet possible to provide a guidance on the 2021 result. With the publication of our half-year results 2021 we will carry out a renewed assessment.

“Food remains the main driver of our growth.”

What is your biggest challenge?

It appears that the epidemiological situation will calm down as vaccines become more widely available. However, it will still take some time before the vaccination programme yields success. This will once more demand a lot from all employees in our network, who have been in crisis mode for a year already. We must make every effort to support our employees to the best of our ability.

How are the employees doing?

The commitment we have been able to rely on is nothing short of incredible. Our employees made last year work by demonstrating perseverance, assuming individual responsibility and showing foresight. The Group Executive Management and I also continue to be greatly impressed at how they are coping with the situation and we are convinced that Valora and its employees will emerge strengthened from the crisis.

“Together, we will emerge strengthened from the crisis.”

What is your basic personal outlook going into 2021?

In 2020, we all created a strong foundation for investing in the future through our good work and strict cost discipline. We have therefore not stood still despite the crisis. Instead, we have equipped ourselves for further growth. We will do more of the same in 2021. Together, we will manage the fallout from the pandemic. We need the support and solidarity of everyone to achieve this.

Photos and videos: Noë Flum.