The retail sector has seen consistent growth in card payments over the past few years. The outbreak of the COVID-19 crisis has given another major boost to the trend, with contactless payment methods proving particularly popular. This is evident from the Valora figures, and applies everywhere regardless of how widespread contactless payment is in any country.

Valora stands for convenience during the entire shopping experience. This convenience includes the speed and range of available payment options. They usually take 30 seconds. Customers have a choice of cash, card payments or payments by mobile phone. Contactless payment via NFC (near field communication) is speeding up the transaction process even more.

It is therefore not surprising that these payment methods are gaining in popularity. At the same time, the cashless payment trend in the DACH region is growing more slowly than in the Nordic countries, such as Norway or Sweden. Nonetheless, the crisis has accelerated the move away from cash in Europe, including in its German-speaking areas. The data from Valora sales outlets proves that.

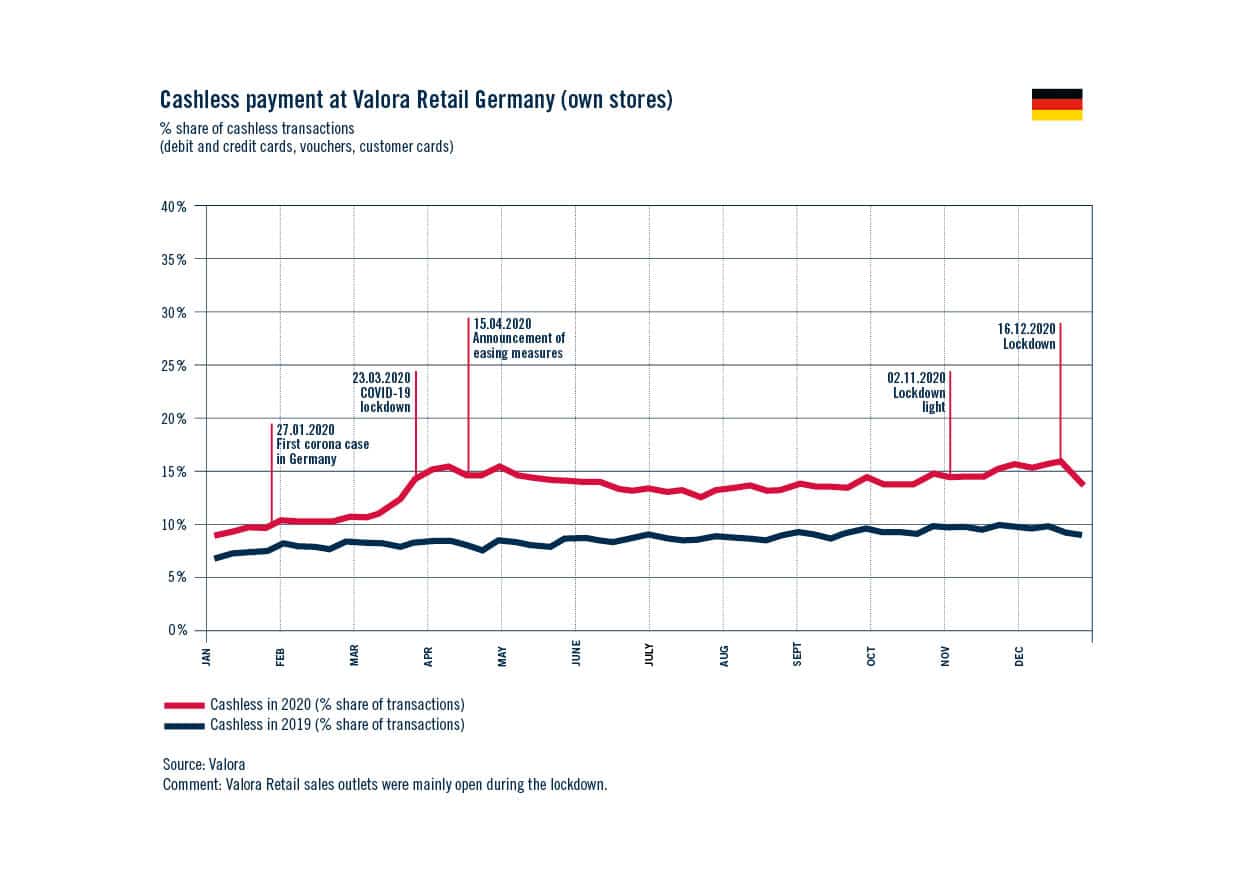

In 2020, the annual average share of cashless transactions at Valora retail formats in Germany rose by almost 55% relative to the previous year (2019: 8.6%, 2020: 13.3%). The main surge of 50% (from 10 to 15%) – was in March alone when Germany was about to start its first lockdown. Following a temporary dip, the proportion of cashless payments rose again (to around 15% by december) due to the second lockdown.

BackWerk and Ditsch, the Valora Food Service formats in Germany, had much the same experience during the year: their share of cashless transactions also rose by more than 50% compared to the previous year. It was 4.5% in 2019, rising to 9.2% in 2020. However, the increase of almost threefold in the course of March was by annual comparison still more striking. The high of 13% occurred at year-end when Germany entered its second lockdown.

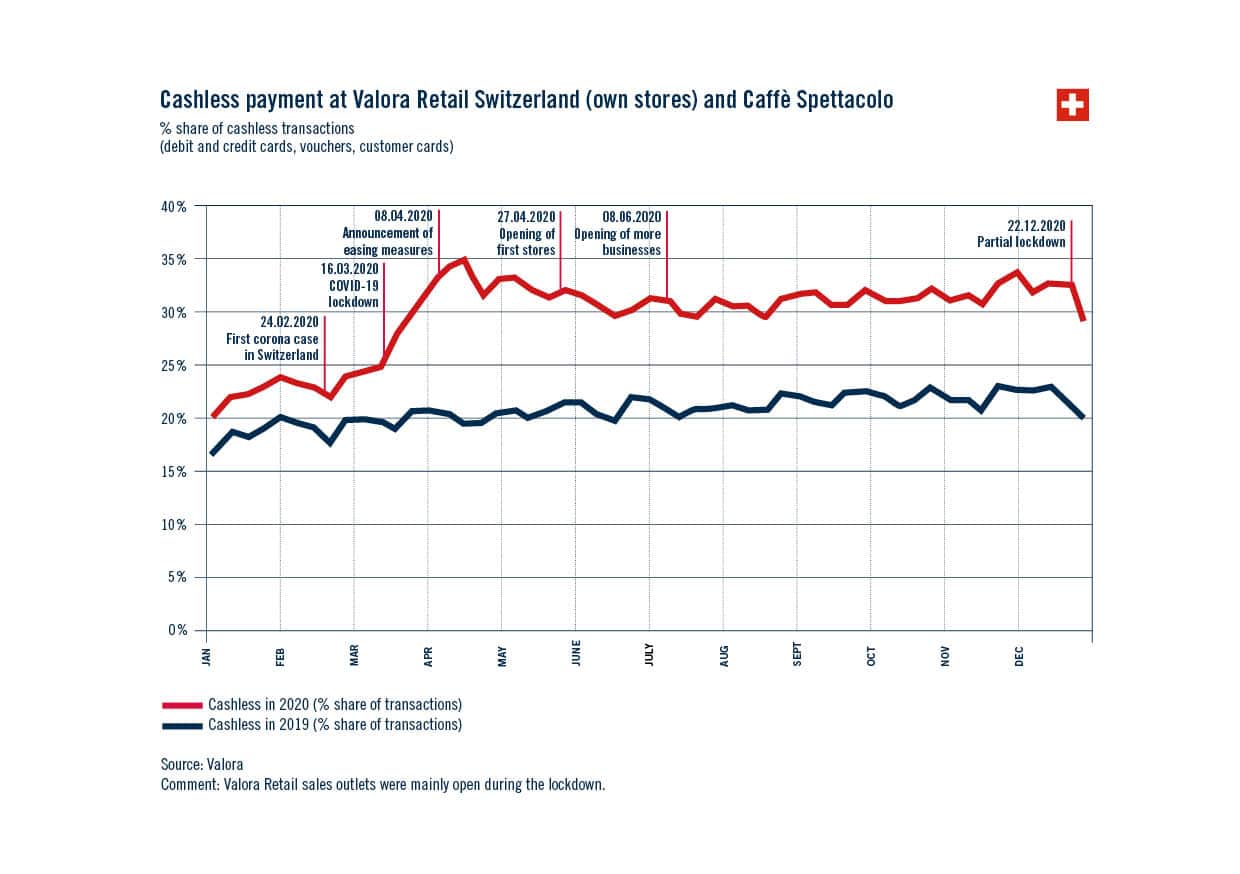

The rise in the share of average annual cashless payments among the retail formats in Switzerland was 43%. The average was 20.8% in 2019, rising to 29.7% in 2020. Contactless payment is normally more widespread in Switzerland than in Germany. The peak in Switzerland came in mid-April at 35%, at the end of December it was 34% following a temporary minor dip.

The share of cashless payments was also up in the Netherlands, where Valora has 31 BackWerk stores. Although, it had also been very high relative to Switzerland and Germany in 2019 (65.7%). The annual value for 2020 was 74.1%. The 80% mark was even exceeded three times. The peak of 87% came in March, just before the stores had to close temporarily by official order. In the 22 BackWerk stores in Austria, the share of cashless payments increased by annual comparison from 12.0 to 19.4%.

Contactless and cashless – for hygiene reasons

The growth in cashless transactions is mainly for hygiene reasons: using a card instead of cash means the payment method does not leave the payer’s hand. The problem: any payment method that is not NFC compatible entails entering the PIN in a terminal, i.e. touching a surface. This has prompted some credit card providers, in light of the pandemic, to increase the limit for contactless payment transactions, even doubling it in some instances. This is reflected in the figures: in 2020, the share of contactless transactions over CHF 10 in Valora’s Swiss and German retail outlets rose by about 14% relative to 2019 in both countries.

Is the cashless payment trend here to stay?

The figures don’t lie: acceptance of cashless payments has increased and the COVID-19 crisis has accelerated the trend beyond expectations. Nonetheless, it is unclear how the trend will develop over the mid to long term. Will customers keep up this behaviour or will they return to cash when the crisis levels off? Or will the preference for cashless payment keep growing?

The consulting firm Oliver Wyman believes that only about 32% of all payments will be in cash by 2025. However, that figure also includes online transactions. Prior to the COVID-19 crisis, Oliver Wyman forecast a decline in cash payments to 37%.

Valora also expects the broad acceptance of cashless and contactless payments to keep increasing. That is not only because of the increase in cashless transactions over the past few months, but also because demand for alternatives to cash – also driven by online retail – have already been growing for years. Valora has started catering to this change in customer behaviour through new retail concepts, such as avec box.

TWINT, Alipay, WeChat Pay: contactless payment at Valora

Valora offers customers at its sales outlets various cashless payment options.

In Switzerland, in addition to contactless cards, there are: Apple Pay, Google Pay, Samsung Pay, TWINT, Alipay and WeChat Pay.

In Germany, there are also the following options depending on the location and format: Apple Pay and Google Pay.

The app developed by fintech company Sonect enables the opposite of cashless payment at k kiosk and Press & Books in Switzerland: cash withdrawals.

This article appeared for the first time on 7 October 2020 and was updated on 24 February 2021.

Photo: Noë Flum / Charts: hilda.