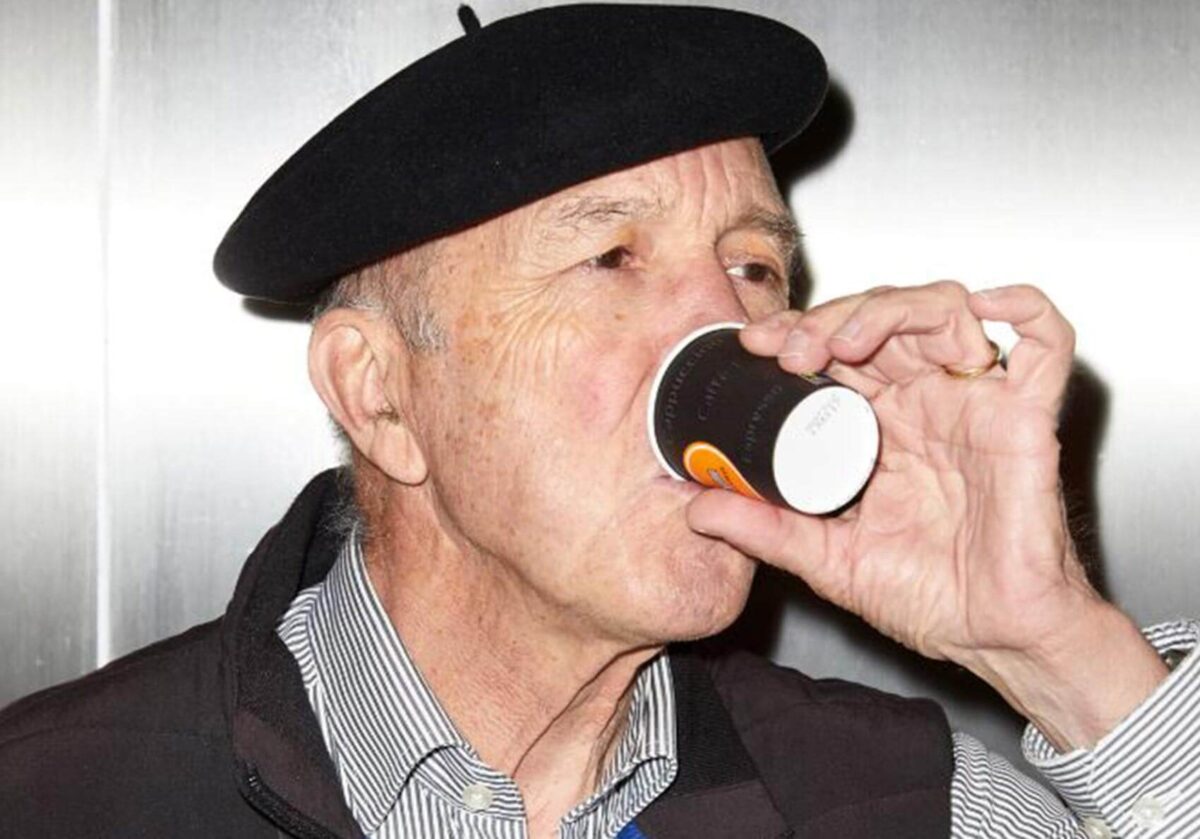

Michael Mueller, CEO of Valora, looks back on the successful development of Valora over the past year and explains why the company is in an excellent position to master the future.

“Right now our focus is on renewing and further developing existing concepts: forward-looking, convenient and fresh.”

Michael Mueller, how did Valora develop in 2018?

We have been pursuing our strategy consistently for years, and we made great progress once again last year. At the beginning of this strategy cycle, the aim was to focus on and consolidate our core business. Since 2015/2016, Valora has seen more growth initiatives, including acquisitions. Right now our focus is on renewing and further developing existing concepts: forward-looking, convenient and fresh.

What specifically did you do last year?

I am particularly proud of the complete revamp of our avec convenience format. The new management team in Switzerland managed to accomplish this in just five months, and we have already applied the new concept to nine sales outlets since July. The concept focuses strictly on the latest foodvenience and ultra-fresh products, which are clearly marked with the new label ‘Handmade with Love’. We now also carry a regional product line – a novelty in small-scale retailing in Switzerland.

And k kiosk, Valora’s most well-known format, stayed the same?

No. We also completely overhauled the k kiosk concept and will be opening the first new sales outlets in the spring of this year. We followed the same approach here as with avec: more food and more freshness. We have also updated the design, added more regional products, and simplified the sales processes. Plus the first Press & Books with a new, modern look has just recently been opened at the Zurich Airport.

You made headlines at the end of 2018 by announcing the first cashier-free store in Switzerland.

avec box is a unique concept that aims to make avec’s foodvenience and fresh product range available 24/7, a development made possible thanks to our efforts in the area of digitalisation. With this format, you access the store using an app, scan the products you want and pay for them directly. Customers can do their shopping any time, and at their own pace. This makes us a leader in innovation in Switzerland.

We are developing a similar concept for k kiosk, but aim to take it a step further: thanks to our cooperation with the Silicon Valley start-up AiFi and its auto-checkout technology, the products do not even have to be scanned. Customers simply walk into the k kiosk box, take what they need and leave again.

This has also earned some criticism.

Yes, and we take that seriously. Among other things, we are being accused of cutting jobs and making working conditions worse for staff.

Well?

We already have around 2,800 sales outlets in the European market and are pursuing a growth strategy. New technologies and concepts like the avec box are helping us to further expand the offering and provide even greater convenience – in the shopping experience too. We simply want to offer people more shopping options and better meet customers’ growing need for flexibility. At the same time, it allows us to access new sites with less footfall. Once we have opened the first avec box in spring 2019, we will have to gain some experience before we roll it out any further.

There is a shift in the focus of staff activities in the avec box. When they’re on duty in the store they will no longer have to be at the checkout, but will have more time for the customers – helping out with the app, the purchasing process or the assortment, for example. At the same time, they take care of the shop.

“New technologies are helping us to further extend the offering and provide even greater convenience – in the shopping experience too.”

In 2017 you bought the German food service bakery BackWerk. How is that going?

The acquisition of BackWerk made us one of the leading snack food providers in Germany. By now, BackWerk has become a permanent part of Valora. We are on track with the opening of new stores, while also eliminating the less lucrative locations from the network. In Frankfurt we opened the first BackWerk at an airport; the first BackWerk in Switzerland under the new concept opened in Winterthur; and we are now offering BackWerk products at ServiceStore DB. At the same time we are also selling our own pretzels and ok.– products through BackWerk. This is a great example of how we are capturing synergies and benefiting from our integrated value chain.

You also mentioned your own pretzels.

Today, we are one of the world’s leading pretzel producers and make about 650 million bakery products a year – for our own sales outlets and primarily for third-party customers (B2B). In 2018, the B2B business posted a strong growth of +5.9% in local currency and our production plants are running at full capacity. This backs up our decision to expand. We already doubled our production capacity at Ditsch USA in 2018. We are on track with building another production line in the US and two new additional lines in Germany and we will be able to start production in the fourth quarter of 2019.

Are you equally satisfied with the B2C business in food service?

Our same-store revenues were up at both Ditsch (+1.4%) and Food Service Switzerland (+2.7%). The latter was certainly helped by the revamp of the Brezelkönig concept in 2018 as well as the further development of our products. We also made considerable progress with the streamlining of the Ditsch store network. Food Service performed well overall, as you can see from the +26.6% rise in net revenues. This increase reflects both the consolidation of BackWerk for a full year and also organic same-store growth. These two effects drove EBIT by +30.1%.

How did the operating business perform overall in 2018?

In the past few years we have always announced ambitious and realistic goals and stuck to them. This is also true for 2018. EBIT rose by +13.7% to CHF 89.8 million. The EBIT margin was +0.3 percentage points higher year-on-year at 4.2%. The gross profit margin improved by +1.9 percentage points to 45.5%. Net revenue increased by +6.0%. Including the sales revenues of our franchise partners, external sales increased by +11.3% to CHF 2,731 million. And in spite of substantial investments in our production sites, free cash flow per share is at the level of the amount of the attractive dividend.

What specifically drove the sales growth?

BackWerk, which was only consolidated for the last two months of 2017, made a major contribution to sales growth in 2018. In addition, there were positive currency effects and higher sales in the other Food Service areas. Retail DE/LU/AT also posted an increase in external sales of +5.2%, mainly due to currency effects. External sales at Retail CH were slightly down by –0.3% compared to the previous year. What I would like to highlight particularly is that Retail CH posted same-store growth of +0.4%. Also, the number of sales outlets was stable in the second half-year for the first time in quite a while. This is a clear affirmation that we are on the right track with the transformation of our kiosk business.

What does the cost situation look like?

Costs rose by +10.4% versus last year – partly due to the full-year consolidation of BackWerk and partly due to higher production volumes. EBIT at Group level improved thanks to BackWerk and the growth in Food Service as well as in Retail CH. This resulted in an increase in operating profitability – absolutely, and in terms of margin.

Talking of profitability, is Retail CH still as profitable?

We were able to keep profitability in this market segment at the high level seen the previous year. Do not forget that the 2017 figures included a book gain from the sale of the building in Geneva following the acquisition of Naville. Operating EBIT rose by +4.6%.

In the past few years we have always announced ambitious and realistic goals and stuck to them.”

The position does not seem as rosy in the German retail business.

Retail DE/AT/LU had a challenging year: EBIT fell by –25.1%. However, we were able to more than make up for this thanks to Food Service and Retail CH.

So was the print media business in Germany still under heavy pressure in the second half of 2018?

Yes, Retail Germany is experiencing an intensified, market-driven decline in high-margin print media with a certain delay to Switzerland. We are taking measures to counteract this, cutting costs and driving the expansion of e-smoke, for example. It will take some time for the measures to have their full effect. In the second half of the year, we were already able to mostly soften the print media effect. Tobacco, food, non-food and services did well, and same-store sales of Retail DE/AT/LU were down by only –0.2%.

Alternative nicotine products seem to be experiencing a boom.

They are fashionable and we are one of the first providers with nation- wide coverage. In Germany we are more advanced with e-smoke than in Switzerland. Even though these are still niche products, demand for e-cigarettes and for ‘heat not burn’ alternatives is steadily rising. Protecting young people is very important for us. That is why Valora applies a minimum age of 18 in Switzerland too for all e-smoke and tobacco products, even though the law does not yet require this everywhere.

What happened in 2018 with the various services mentioned before?

Services are becoming increasingly important and are helping us to compensate the decline in print media. This is made possible by innovative digital solutions with third-party companies and our dense network of sales outlets. Our network is highly attractive, especially for new payment or pick-up / drop-off options. We were able to expand the Swisscom easy point offering launched at the start of 2018 over the course of the year. We now also have the Sonect app, which allows customers to withdraw cash in Swiss kiosks. In Germany we offer the new ‘amazon top up in store’. These are just some of the examples that show how the shopping of tomorrow is bringing the online world and physical sales outlets together again.

bob Finance is mainly involved in online business. How are you getting on?

bob Finance had a profitable second half-year and we now wish to invest more in this business. In 2018, the offering was expanded with new digital payment and financing products for the B2B2C area. Partners benefit from rising sales, while customers enjoy more convenience. Consequently, the products meet with high interest from online as well as stationary retailers. The first partnerships were launched successfully.

“The shopping of tomorrow is bringing the online world and physical sales outlets together again.”

The Future Store is also meant to be something new. What can we expect there?

The Future Store in Zurich main station is scheduled to open in April 2019. It will be called avec X and will mainly be a test lab for Valora to try out newly developed digital aspects of the shopping experience like checkout processes and personalised shopping, along with other forward-looking themes in the convenience segment.

And what is the long-term destination for Valora itself?

Valora offers the best food and convenience concepts. That is our vision. To achieve this, we strive for operational excellence, ongoing innovation and agility, and optimum value creation. This is based on the underlying premise of a comprehensive understanding of the customers and formats.

What strategic levers do you have available to help you achieve this vision?

We have further sharpened our corporate strategy. We want to extend the foodvenience locations in transport hubs and inner cities. We will do this together with our agency and franchise partners. We also want to further promote our internal product competence through our own production and own brands such as ok.–. At the same time we are continuing to develop the international B2B distribution and production business for our pretzel products. All this will be done using simplified processes and the latest technology for a delightful customer experience. We also attach more importance to sustainability.

Has sustainability not been an issue for Valora before?

Of course it has. But to date sustainability has not been embedded in our strategy systematically enough. We are changing this now. Our stakeholders rightly expect Valora, as a responsible company, to make its contribution to sustainable development for people and the environment.

Valora has reorganised itself in response to the strategy. Why was that necessary?

We want to be closer to the customers, integrate new businesses more easily, exploit synergies and profit more from the wealth of know-how available in the company. So we have grouped together the things that belong together and made the structure consistent. There are now two divisions with a market and customer focus, Retail and Food Service, and Group-wide Shared Services. Among others, we have combined the B2C formats BackWerk and Ditsch in Germany and placed Digital Innovation directly under the CEO. The new structure will make us stronger.

“To date sustainability has not been embedded in our strategy systematically enough. We are changing this now.”

How do you drive the growth going forward?

We specifically align our formats to the latest customer needs and have strong brands that still have great growth potential. With the renewed formats Valora is ideally positioned to profit from the global growth trends in convenience and on-the-go consumption. We will in future also offer more unique snacking experiences at an attractive price and expand our range of services for people on the move. Our investments in the production facilities will also pay off from 2020 onwards. We see further opportunities for growth with BackWerk in the Netherlands and Austria, and using international franchise partners for Brezelkönig. Finally, our capital base allows us to make acquisitions that add to our formats and/or expertise – we look at opportunities on a regular basis.

How do you see your capital strength and long-term financing?

Our reliability and credibility have allowed us to further optimise our capital structure in the past year. We placed a Schuldschein issue of EUR 170 million at the beginning of the year. This was followed by a Schuldschein issue for another EUR 100 million and CHF 63 million in December 2018, which was used to refinance an expiring EUR Schuldschein issue and part of a CHF hybrid bond. The Swiss franc tranche was an innovation in the market. Demand was strong, well above our expectations. This allowed us to benefit from the attractive market conditions and further cut our financing costs.

Might the possible loss of rental space as a result of the current SBB tender be a stumbling block?

We have made an excellent submission and are convinced that our new and refreshed formats meet the needs of train travellers precisely. We are therefore optimistic that we will be able to successfully continue the strong and long-standing partnership with the SBB. Our unique expertise in small-scale retailing at heavily frequented sites and the strong offering of unique products and innovative services will be powerful arguments for awarding the sites to Valora again.

“Valora is ideally positioned to profit from the global growth trends in convenience and on-the-go consumption.”

So you are optimistic for 2019?

Yes. We will benefit from the advantages of the new organisational structure, and also the additional synergy effects between the formats and markets. Many of the measures taken in 2018 will have a greater impact in the new year. These include not least the continued rollout of the new avec concept and the launch of the revised k kiosk concept. The higher food share will help us in terms of both customer frequency and margins. In recent years we have demonstrated that our business model is very resilient and that we are able to deliver on our promises.