Michael Mueller, would you agree that 2017 was a good year for Valora?

Yes. We have completed our transformation into a focused convenience and food service provider, while at the same time setting the course for future growth with the acquisition of BackWerk and Pretzel Baron as well as the decision to expand our pretzel production capacity. In addition, we have made significant progress in the area of efficiency and process optimisation. And we finally completed the Naville integration with the sale of the La Praille building. All in all, it was a successful year.

What do you think were some of the highlights?

The acquisition of BackWerk is a landmark in our growth strategy we have communicated. We are thus now one of the leading vertically integrated food service providers in Germany. Another important highlight to note here is the trust shown by our shareholders, which was demonstrated by their approval of the capital increase. Furthermore, with the increase in the gross profit margin to 42.0 %, we have already achieved our medium-term goal for 2018. Excluding the acquisition costs and EBIT contribution from BackWerk, the EBIT margin stands at 4.0 %, meaning that we have also achieved this target one year ahead of schedule.

Let us talk about BackWerk for a moment. What potential does this format offer?

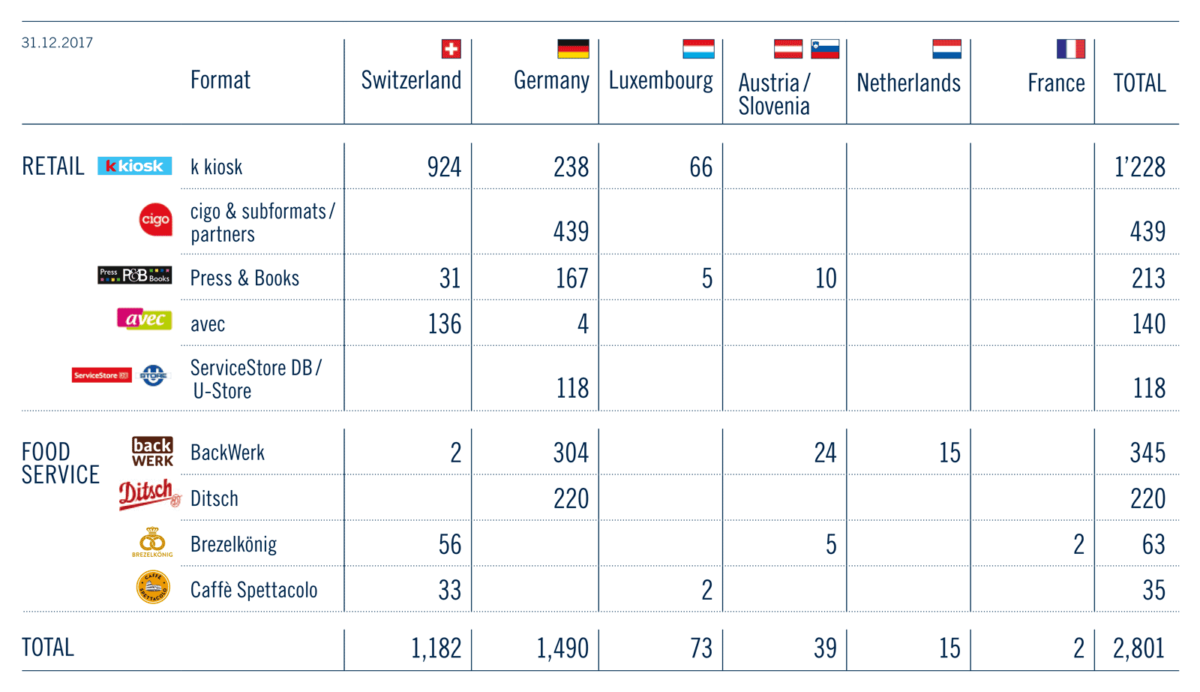

BackWerk, with its 345 points of sale, perfectly complements our other food service formats, such as Ditsch, Brezelkönig and Caffè Spettacolo, ideally supplementing these formats thanks to its “feel good food” concept. BackWerk’s city centre locations also complement our existing sites at transport hubs and shopping centres. Finally, BackWerk is an excellent steppingstone for the further internationalisation of Valora, as it gives us access to the Netherlands, which is a new market for us.

“We are now one of the leading vertically integrated food service providers in Germany.”

How many new BackWerk locations do you plan to open in the coming year?

It is our goal to open 80 to 100 new BackWerk locations, gross, over the next five years. In doing so, our focus will be on the countries where we currently operate, i.e. Germany, Austria and the Netherlands. We also plan to open several new locations in Switzerland.

As part of the acquisition, you carried out a capital increase. Overall, how do things stand in terms of Valora’s capital strength?

We have a very balanced financing structure and we have the resources to continue our growth. With our long-term financing strategy, we want to secure our future strategic and financial flexibility. The capital increase must be viewed in connection with the overall refinancing strategy. For example, in 2018 we also placed a new Schuldschein issue for EUR 170 million at highly attractive market conditions. These elements are used to refinance the BackWerk acquisition, to further finance the planned expansion of pretzel production capacities and to refinance the capital market instruments that will fall due in 2018.

“We have a very balanced financing structure and we have the resources to continue our growth.”

In addition to BackWerk, you also acquired US pretzel producer Pretzel Baron.

Yes. Although it is a fairly small company, we see great potential. This acquisition will enable us to increase our footprint in the US – a market that, in terms of pretzel consumption, is already almost as large as Germany. Previously, we supplied the US from Germany, but our production capacity has become tight there. For this reason, we will invest a total of around EUR 50 million in the expansion of production in Germany and in the US in 2018/2019.

Last year was characterised by acquisitions. How was the operational business?

We are pleased that we were able to confirm the communicated expectations. The EBIT climbed by +9.3% to CHF 79.0 million. The EBIT margin increased by +0.4 percentage points to 3.8%. As mentioned, the gross profit margin improved to 42.0% (+0.5 percentage points). Without Naville Distribution, which was sold in 2016, net revenues would have increased by +0.9% on a year-on-year basis.

Can you give us details on how things went on the revenue side?

Retail Germany/Luxembourg recorded an increase in sales of +7.0%, while the Food Service division realised an increase of +10.5%. This growth is driven by a higher number of outlets operated by Valora itself and by positive same-store sales development, especially in the case of the Food Service formats (B2C). We also generated more sales in the B2B area – despite the replacement of a production line during ongoing operations in Oranienbaum. The growth at Retail Germany/Luxembourg and at Food Service more than offset the lower revenues generated at Retail Switzerland/Austria (-3.4%). The decline here was primarily due to a lower number of sales outlets and a lower same-store index.

And on the cost side?

Our ongoing cost discipline, optimisations in our range and processes as well as adjustments in our network have led to an overall improvement in the EBIT margin. Particularly in Switzerland, we greatly increased profitability. In contrast, the profitability of Retail Germany/Luxembourg and in the Food Service division temporarily remained under pressure. However, we not only made savings, but the minimum wages for our employees in Germany and Switzerland have also been increased.

You also concluded a new collective labour agreement in Switzerland.

Yes. Following constructive discussions with our new social partner, the Kaufmännischer Verband, we concluded a new collective labour agreement (CLA) for all employees in Switzerland who are not already covered by another collective labour agreement. As part of this agreement, we increased gross minimum wages across the board and awarded professional qualification higher. Education should also be financially worthwhile, and we want to be a fair, attractive employer where employees can develop.

However, there has been criticism that the pay increases are too small and, in particular, that employees at k kiosk agencies have not benefited from them.

It is important to look at the context when you talk about wages. Our situation, with small-scale points of sale at highly frequented locations, is different from that of large retailers. Nor is the criticism justified regarding our agency partners. They are free to join the collective labour agreement. Also, whenever there is a new contract with us, they are required to abide by the minimum wage defined in the current CLA. Previously, they were required to pay the minimum wage based on the CLA that was in force when the agency opened.

Let us first take a quick look back and talk about the Food Service division. Did it meet your expectations last year?

Yes, absolutely. We realised a good performance in all formats. In Switzerland, our same-store sales at Brezelkönig and Caffè Spettacolo grew by +2.9%, while in Germany we recorded growth of +1.5% with Ditsch. In the B2B business, we grew +3.7%. Increases in revenue were roughly on balance with higher costs, especially with respect to diary prices. The division’s overall revenues increased consiberably despite the conversion work in Oranienbaum, which is a very good basis for further growth.

What are the next steps in the international expansion of Valora’s Food Service division?

In the B2B area, demand for our products is outpacing production capacity, which is why the planned capacity expansions are urgently needed. On the one hand, this demand is coming from our current sales markets in Europe, but we also see high growth potential in the US, where we are represented by Pretzel Baron, and in our current export markets. In the B2C area, on the other hand, our focus is on our current markets in Switzerland, Germany and Austria, and, since the acquisition of BackWerk, also in the Netherlands. For Brezelkönig International, we have just won the food travel group SSP as our first franchise partner in Austria and opened a joint store at Vienna Schwechat Airport.

So the focus in future will be on the franchise model?

Yes, Valora has had good experiences with this model as well as with the agency partner model. We already operate 69% of our sales outlets under these models. The franchisees act as entrepreneurs and thus participate in the shared success. BackWerk, a very well-known and established franchise concept, is now part of the Group and on the whole we will benefit from its experiences.

How did the retail business do last year?

Consumer behaviour is changing substantially, which has also an impact on print media and tobacco sales. Print media products recorded another decline in Switzerland and Germany. In Switzerland, tobacco product sales fell, while in Germany this product category benefited from market consolidation and even grew. Our strong ok.– brand also saw very positive growth, and the more than 700 modules with coffee from Caffè Spettacolo and Starbucks that we installed in our Swiss points of sale proved to be very popular among customers. We also see high potential in the convenience business, which is especially relevant for our avec format.

What is next then for avec?

We have developed the concept over the past year and already tested it at two locations in Switzerland. This concept will receive even more attention this year. We are confident that the new fresh product concept will help avec grow further as well.

You also introduced CBD hemp products in Switzerland last year. How is this product range doing?

Demand is high. These products seem to meet a real customer need. However, they remain interesting niche products. We see especially significant demand in alternative nicotine and e-smoke products, which we introduced in 2017. In Germany, in particular, we have pushed ahead with the e-smoking rollout. Tobacco – including corresponding alternative and replacement products – remains a strong driver of customer footfall.

One growth initiative in the retail area involves the business as a service partner for third parties. How are things going here?

We are pleased that we continue to be able to sell public transport tickets in Switzerland. The customer response to the announcement by the SBB that it would suspend this service was in some cases very strong. We have also further expanded our cooperation with Swiss Post and are increasingly offering pick-up/drop-off services, including with Swisscom easy point. Customers can also increasingly pay in cash for their online orders at our points of sale. Our offering of other financial services has also developed further. This includes our consumer credit products from bob Finance.

How do things stand financially with the latter?

We are satisfied with the number of customers and have further strengthened our market position. The lifetime value of our consumer credit business has been positive for some time now and the key figures are developing satisfactorily.

And what are the plans for Valora’s retail business this year?

The retail business is an important pillar of our strategy. However, we need to further expand the existing business with updated concepts, adjustments to our product range, new service offerings and measures aimed at increasing efficiency. This requires innovation, which along with digitalisation, is a driver in the retail business.

“Innovation is required, which along with digitalisation, is a driver in the retail business.”

You repeatedly emphasise the great opportunities that digitalisation offers for Valora. How does this impact business specifically?

It allows for new services such as those mentioned above, which we bring to market either on our own or together with partners. Our digital strategy also supports our promotional and loyalty activities, such as the k kiosk app, which was recognised with an award by NACS, a convenience industry organisation. Digitalisation also has a substantial impact on our efficiency and our processes.

Can you give an example of this?

Last year, we built an easily scalable and well-structured communication platform for our sales staff on Google Cloud and rolled it out to all Swiss retail points of sale in record time. In doing so, we have replaced seven applications. The simplified sales communication with VAPOS.info will also allow us to make new offerings available more quickly in our points of sale. We will now connect our other formats to it in stages.

Not all of Valora’s experiences with digitalisation have been good. There was much criticism of the customer flow analysis pilot at the Zurich Main Station.

Valora takes the issue of data protection very seriously and works intensively to examine corresponding projects in advance, from both a technical and legal perspective. However, we definitely did not provide enough information at that time. All we wanted to do was take advantage of the WiFi signals of smartphones to measure customer flows. We would use this information, for example, to optimise staffing. The aggregate data that Valora received in connection with the project could not be attributed to a specific person at any time due to the data’s anonymity. Generally speaking, we are interested in approaches and solutions that can provide us with valuable information, but naturally always ensuring that they comply with the relevant data protection legislation and offer customer benefits.

“We aim to brighten up our customers’ journey – nearby, quick, convenient and always full of fresh ideas.”

Where will Valora focus in 2018?

Valora will focus on the further expansion of the food and drink offering as well as the implementation of our new fresh product concept in the entire kiosk and convenience business. We will also focus on the consolidation of the BackWerk acquisition, our ongoing international expansion and the implementation of the planned expansion of our production capacity. In addition, we will invest in our innovation capacity as well as new digital offerings and the digitalisation of our processes. So we have a lot of work ahead of us, but we are well positioned in terms of management and organisation. And the two new members of the expanded Group Executive Management – Roger Vogt as CEO of Retail Switzerland & Austria and Philipp Angehrn as Head of Transformation & Project Management Office – will help us in these efforts.

Given the pace and amount of change, will employees be able to keep up?

I am sure they will. We have excellent employees on all levels and in all formats. I would like to take this opportunity to thank all employees for their commitment and their motivation. Valora wants to provide employees with prospects and allow them to make a real difference themselves. We aim to brighten up our customers’ journey – nearby, quick, convenient and always full of fresh ideas. A positive corporate culture is important for our success.

What concerns you when you look ahead to the coming months?

The accelerated decline of print media, historically high prices for raw materials for dairy products, declining footfall in shopping centres and greater competitive pressure in highly frequented locations remain challenging factors. But I am convinced that we at Valora have all reason to be optimistic. We are optimally positioned to take advantage of the ongoing trend towards high-margin “foodvenience”, the increasing number of visitors at highly frequented locations, more customised products and the merging of digital and physical offerings. However, we cannot afford to stand still and must instead be innovative and agile.

Are further acquisitions being considered?

Yes, because we generally follow a growth strategy and the acquisition of BackWerk was certainly not the last one. Our long-term financing strategy allows us to review such opportunities at all times. At the same time, however, we also want to invest in organic growth, the current business and innovative offerings.

“We are optimally positioned to take advantage of the ongoing trend towards highmargin ‘foodvenience’.”